THE FEDERAL RESERVE IS PRINTING MONEY J. I. Nelson, Ph.D.

October 2010

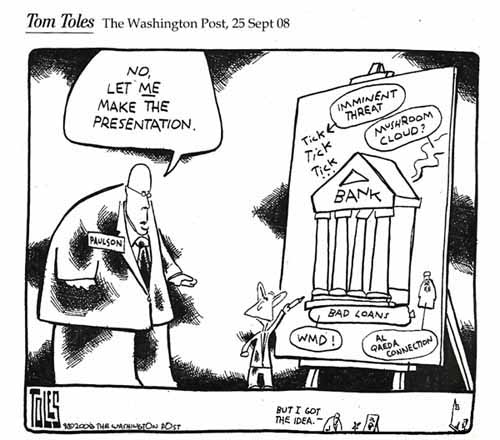

An earlier 2008 article says the debt is enormous and the TARP bailout is justified.

This article says it was willful fraud, the Fed is printing trillions to hide it, and I was naive to fall for TARP.For a brief overview, go here.Bottom: TABLE of CONTENTS & links

In

the last three weeks, we have finally done a half-baked investigation

--- nothing like we did in the Savings & Loan days -- of Washington

Mutual (WaMu), Citicorp, Lehman, and Goldman. And we have found strong

evidence of fraud at all four places. And we have looked previously at

Fannie and Freddie and found the same thing. So the only six places

we've looked, at really elite institutions, we've found strong evidence

of fraud. So where are the other investigations? Why are there no

arrests? Why are there no convictions?

--William K. Black, 23Apr2010, former bank regulator during the Savings and Loan crisis, 1980s.

full transcript;

video

PREFACE -- TWO BLUNDERS

I

have made two political blunders in my life. I supported the

"shock and awe" second invasion of Iraq in March, 2003, thinking one

dictatorship less in the world couldn't hurt. My father, a CIA

agent running covert operations in post-World War II Europe,

participated in his generation's reconstruction of Europe's social

democracies. My generation destroyed Iraqi's

families, society and future.

Oops.

This

essay is about my second blunder: I supported TARP, the $700B

Troubled Asset Relief Program. You know the phrases:

"securitized mortgage bundles", "collateralized debt

obligations", "credit default swaps", derivatives of all kinds.

It was almost humorous sorting them all out and you might have fun

reading my rundown of what all the toxic assets are and how we got them.

I concluded that it was really bad. The crisis in late 2008 was global, and too big not to be immediately

neutralized with money (injected liquidity). Why? What's the

alternative? In a nutshell, everyone around the world would

have gotten clobbered in his personal life, or would have known a

financially-ruined person, and that psychological blow would have

brought us a Great Depression, globally, and on Internet time.

I

supported TARP, but as a first step. My parents' generation

followed their own bank collapse with criminal investigations (the

Pecora Commission), with

the creation of the Securities Exchange Commission, the Federal Deposit

Insurance Corporation, with the structural changes in the

financial industry that our generation dismantled.

Stupidity is its own reward.

Now

our actions had run their course, producing financial collapse on a

global scale. If what we did was even worse than what happened in

the 1932-1933 bank collapse, then the flood of criminal investigations,

new agencies, and structural changes backed by Congressional law would

surely be greater also. Now it was even time for my generation to

question capitalism and fix it. We wouldn't waste time as the old

generation had, with Marxism and its Communist

dictatorships. We would create a productive, sustainable world,

pro-business and pro-everybody.

You

know what happened. Nothing. Money went to bankers

who mailed bonuses to themselves and foreclosure notices to

everyone else.

I had nothing more to say -- the country has lost its

way, things will get worse. Then I noticed the Federal Reserve

had printed a trillion dollars in money, wired another trillion

overseas, and then last Saturday (16Oct2010) floated the idea

that it would be a good thing for "the economic recovery" to

print a trillion more.

Time

to take a second look at all this, and here it is. We are in

deeper trouble than I thought. In what follows, I've tried to

nail down how many dollars and how much fraud we are not facing, and

what kind of a future we will all certainly face for this foolishness.

It

is financially advantageous to change a useless mortgage -- which no

one will pay -- into one that works. And yet the financial industry fought

against this in Congress, and fights against it in the conduct of their own foreclosure

procedures. If the financial industry appears to be working

against their own interests, then there is something more I do not

understand. I've found it, here comes the answer, it is painful,

I'm sorry.

I

withdraw my support for TARP. We have let the privileged,

influential people who created the current economic collapse reward

themselves for it. Apparently we as a society cannot jail them

for fraud, or even remove them for poor performance. So I

withdraw TARP even if that means global collapse.

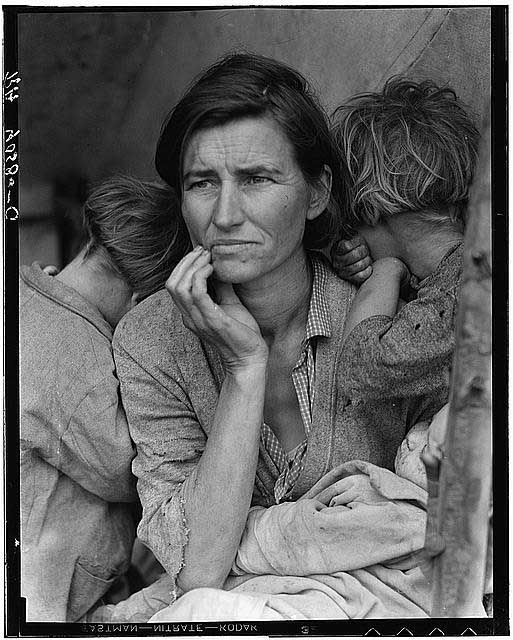

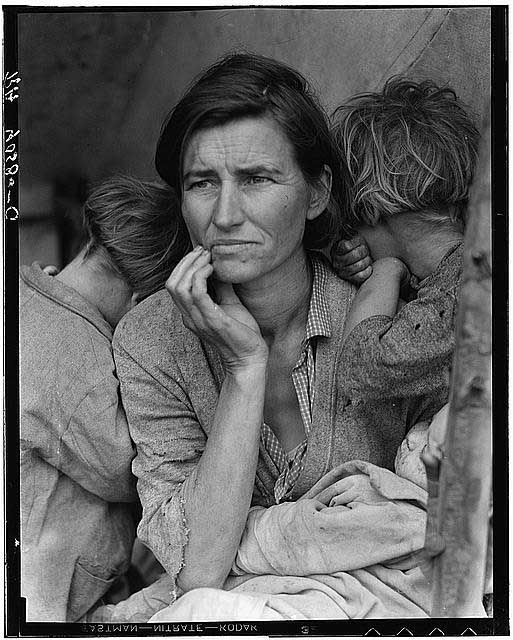

Tremendous

hardship teaches moral values. For my parents and their

generation, it was the Great Depression and Hitler's near-conquest of

the entire Western world. For us, the ultimate hardships lie

ahead in our time, the Cataclysmic Century.

"What Nature doesn't do to us will be done by our fellow man."

--Sheldon Harnick, for the Kingston Trio

INTRODUCTION

You

probably heard talk that the Federal Reserve has moved trillions

of dollars around. This Saturday the Fed's current chairman

floated the idea of printing a trillion more. I am not

comfortable watching the Fed print trillions of dollars in money.

It never happened on this scale before,it's new, I'm uncomfortable with

it.

How

does the Fed do it? Where does the money go? What will it

look like if we get severe deflation because we don't print the money,

or severe inflation if we do? This is pretty quick to sketch out.

WHAT IS THE FED BUYING?

The Fed will buy long-term treasuries and mortgage-backed securities.

After paying for them, it will list these on its books as owned "assets".

WHERE IS THE FED GETTING THE MONEY?

The FED is getting the money out of thin air. It just declares that it has the money.

HOW DOES THE FED CREATE MONEY OUT OF THIN AIR?

All banks can wire other institutions large sums of money.

There

is only one bank -- The Federal Reserve -- that does not have to record

any debit (withdrawal) on its books when it wires money out. The

Fed only records the accumulation of the "assets" it bought. The Fed is

"printing money." But the vast sums (a trillion at a time)

are transferred electronically, so printing is not necessary.

The

U.S. Federal Reserve (our nation's central bank) is not supposed to own

assets. In the long run, the assets should be sold

back. When sold, the assets go back into the economy, and the

money paid for them is taken out of circulation (out of the money

supply) and disappears back into the Federal Reserve. But if the

assets are worthless, they cannot be sold, and the trillions of dollars

cannot be withdrawn from the money supply. This money feeds

inflation.

As in desperate countries of the past (Germany's Weimar Republic in the 1920s), "printing"

money and pumping it into the overall supply of money leads to severe

inflation ("hyperinflation"). So the Fed will be successful in

stopping deflation now. But the Fed may have a problem avoiding

inflation later.

WHAT CRISIS JUSTIFIES PRINTING MONEY AND SENDING IT TO BANKS?

This

time, we are not told that we must hand out money because banks that are

too big to fail are about to fail. This time, the Federal Reserve

can't understand why we are not seeing happy people shopping at the

malls, and it thinks this money will help. Both the Federal

Discount Rate for Fed loans to banks, and the largely symbolic

overnight Federal Funds Rate are under 1%. The Fed can't lower

interest rates much more, so the only thing the Fed has left to

try is printing money. And, if we don't let it try, the economy

will fail. The economy will fail through "deflation".

Current policies may produce deflation followed by inflation, so let's look at both.

DEFLATION 101

During

deflation, nobody buys today what will be cheaper tomorrow.

Jobless people who can't get their hands on any money give away their

possessions, their homes, for next to nothing. Consumers barter;

no one has much money.

Companies

don't want to hire people or invest in manufacturing machinery when no

one is buying products. And, if companies wanted to invest, it

would be hard to find lenders for both psychological and physical

reasons.

PSYCHOLOGICAL

AND PHYSICAL BARRIERS in DEFLATION -- Psychologically, deflation

means no growth and no upbeat feeling. People are not

itchy to find some way to get "it" now, whether "it" is a

franchise on the corner, or brand recognition and market share

for a new product. People are not itching to get "it"

before someone else does ---not itching to do "it" even if they

have to borrow today to achieve their Great Tomorrow. Using force

to pull a house away from someone against their will is humiliating and helps people to feel this way.

feeling. People are not

itchy to find some way to get "it" now, whether "it" is a

franchise on the corner, or brand recognition and market share

for a new product. People are not itching to get "it"

before someone else does ---not itching to do "it" even if they

have to borrow today to achieve their Great Tomorrow. Using force

to pull a house away from someone against their will is humiliating and helps people to feel this way.

Physically,

no one in a deflation (in a Great Depression) has made money selling

any thing or service, so there are no piles of winnings to lend out

again (loan, invest) in the hopes of another win. During

deflation, lenders think borrowers on the other side of the desk will

fail. A pile of cash grows in value as prices fall. Hoarding is

good. Cash sent out to create a building, a line of machines

producing gadgets, etc. turns into worthless things no one wants to

buy. You can't turn those things back into cash again. Your

investment (the foreclosed mortgage, the bankrupt factory) is

worthless. Your money is gone.

INFRASTRUCTURE

-- During deflation, large investments in national infrastructure are

one of the few, best ways to invest money without losing it

later. Wealth can be created from investments in water systems,

sewerage, electricity transport from wind farms & to electric

vehicles, investments in communications at higher bandwidth and lower cost ,

modernized rail systems, putting up better public school buildings,

putting up better public hospital buildings, creating public

health facilities, investing in parks and recreation facilities that

embrace all members of society who work hard and need a break.

From such investments, the wealth continues to flow back for

entire generations, but some wealth comes immediately from placing

money into the hands of jobless people who were buying nothing.

Typically, it takes the national government to initiate investments in

national infrastructure.

We

will see that the Federal Reserve has purchased 1.45 trillion dollars

in assets without purchasing any new national infrastructure.

Non-recovery

policies drive the current non-recovery toward depression and

deflation. But repeated, massive inflation of the money supply without buying

prosperity will eventually bring inflation, to which we now turn.

INFLATION 101

During

inflation, money left in a pile evaporates in value. Consumers

must spend before the price goes up. People higher up in society

must invest. Growth and prosperity always bring a little

inflation. With even more inflation, the government can repay the

national debt in dollars that don't buy what they used to, dollars that

are cheap and easy for the government to obtain. Without

cost-of-living adjustments ("COLA"), pensions and social

security become worthless. In the looking-glass world of

inflation, secure assets disintegrate. For example, the

defined-benefit pension with its fixed-sum payouts becomes

trivial. Investment and a variable pension depending on the

unpredictable market -- what seemed the high-risk choice in

stable times -- becomes the only way you and your assets can

survive.

INFLATION BRINGS BUBBLES

-- When everyone acts this way -- indiscriminate investing -- all

investments work. When all investments work for psychological (no

rational evaluation) and market reasons (there is always a buyer

for what you should not have acquired in the first place), then

we have a bubble. Items in a bubble have value because people

want them.

There

is also real value in all bubbles. Some of the dot-coms have

value (Yahoo, eBay, Amazon, Google). Some of the

telecommunications networks have value (Level Three). Some of the

real estate is desirable, currently occupied by prosperous owners, and

still carries an older, more reasonable price tag. But we can

create new ventures on paper faster than we can build them into

profitability (dot-coms). And too much of a good thing produces a

saturated, commoditized market in which prices shrink and profits

vanish (for telecom networks phone calls -- once a $100B business

for local calls and $80B for long distance ones -- are

suddenly free). Any value set chiefly by

psychology is free to attain irrational values (real

estate). Bubbles (dot com, telecom) produce a lot of trash

investments. We will see that in a really good bubble like

the American real estate bubble that burst in 2008, more than

psychological irrationality (in personal choice) and market frenzy (in

setting value) were at play. Bad investments were produced by

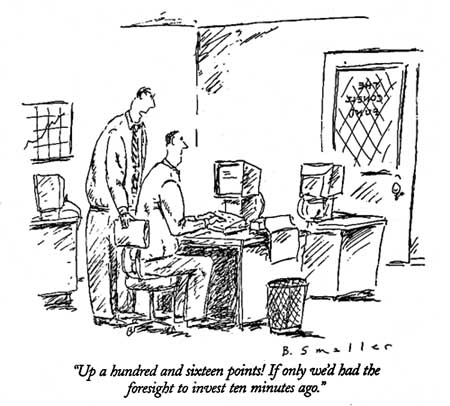

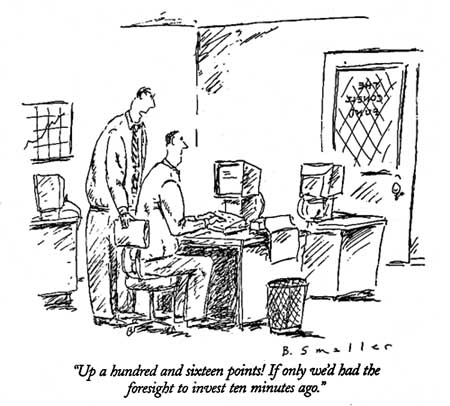

willful fraud. (The cartoon is by Barbara Smaller. Get it on a mugs or T-shirts at cartoonbank.com.)

There

is also real value in all bubbles. Some of the dot-coms have

value (Yahoo, eBay, Amazon, Google). Some of the

telecommunications networks have value (Level Three). Some of the

real estate is desirable, currently occupied by prosperous owners, and

still carries an older, more reasonable price tag. But we can

create new ventures on paper faster than we can build them into

profitability (dot-coms). And too much of a good thing produces a

saturated, commoditized market in which prices shrink and profits

vanish (for telecom networks phone calls -- once a $100B business

for local calls and $80B for long distance ones -- are

suddenly free). Any value set chiefly by

psychology is free to attain irrational values (real

estate). Bubbles (dot com, telecom) produce a lot of trash

investments. We will see that in a really good bubble like

the American real estate bubble that burst in 2008, more than

psychological irrationality (in personal choice) and market frenzy (in

setting value) were at play. Bad investments were produced by

willful fraud. (The cartoon is by Barbara Smaller. Get it on a mugs or T-shirts at cartoonbank.com.)

BUBBLES ALWAYS BURST

-- When the only thing valuable about most things (a dot com, a telecom

network giant, real-estate) is that people want them, the bubble is set

to burst. No one can tell when the burst will occur, and it is

rational for most people to be invested in it because of the

inflation. Investment is rational because the choice was

not between stupid investment and a safe pile of cash. The choice

during inflation was between possibly stupid investment and a most

certainly disappearing pile of cash. Not investing is punishable

by economic law: your cash pile slowly evaporates. It's rational

to invest, the gun is pointed at your head, your own finger is

not on the trigger. Bubbles are so much fun.

When

the psychology changes, the bubble bursts. The "bursting" is not

economic, it is psychological. People shove all companies towards

bankruptcy as indiscriminately as they shoved money towards any company

during the bubble. Inflation, booms and bubbles (followed by

busts, recessions and depressions) destroy wealth insofar as money that

could be doing good things is tied up in silly things instead during

the boom. When the bust comes, wealth is destroyed as

companies disassemble themselves, liquidate and sell off

what would otherwise have done good for the owners, done good for

their investors, and done good for the country. We never get to

enjoy the goods and services, the innovative methods they were

trying to create.

When

the psychology changes, the bubble bursts. The "bursting" is not

economic, it is psychological. People shove all companies towards

bankruptcy as indiscriminately as they shoved money towards any company

during the bubble. Inflation, booms and bubbles (followed by

busts, recessions and depressions) destroy wealth insofar as money that

could be doing good things is tied up in silly things instead during

the boom. When the bust comes, wealth is destroyed as

companies disassemble themselves, liquidate and sell off

what would otherwise have done good for the owners, done good for

their investors, and done good for the country. We never get to

enjoy the goods and services, the innovative methods they were

trying to create.

Countries

that are stable economically tend to purchase the wealth of countries

that go boom and bust a lot. During a bust, the purchases

of things worth a dollar are made for ten or twenty cents. The

United States invented the laser, invented low-loss optical fibers,

developed practical erbium doped optical amplifiers, Raman-pumped

undersea cables, dense wavelength division multiplexing to magically

increase network capacities 32 fold. During the telecom bust,

Asian companies bought trans-Pacific networks containing all this for

10¢ to 20¢ on the dollar. It's gone.

WHAT'S MISSING? WHY IS NOTHING GETTING FIXED?Something is wrong with this Goldilocks choice between deflation and inflation.

Alan

Greenspan played Goldilocks and got it just right. Rates were

high enough to slow the overheated economy, without going too high and

crashing it. We got our "soft landing." Now I am supposed to

believe in a new Goldilocks game, a soft landing between enough

trillions of printed money to escape a deflationary death spiral, but not too much to drive us into inflationary instability. Is that the picture?

I

don't think so. Three "no compute" issues leave me with nagging

doubts that any of us have the picture yet. .

1. FACE VALUE:

It makes financial sense to realign mortgages with the true underlying

value of the collateral asset, the home, but banks are not doing this.

The face values printed on a mortgage that no one will pay are

meaningless. You and I do not yet know why the

mortgage paper is so tied to the fraudulent number printed on it.

2. FORECLOSURES:

For economic recovery, it makes political and economic sense to stop

as many foreclosures as possible. Yet there is no political will to

stop foreclosures even when they are based on illegal procedures (no

personal review of the victim's case) and fraudulent paper work (the

entity pursuing the victim does not own the mortgage). Just for

expository purposes, let's pretend for a moment that politics is

dysfunctional and politicians are corrupt, so that none of them

exercise any wisdom or integrity of their own. Fine. But

why is pressure to recycle occupants coming from the financial industry even though it would be better for the neighborhood, families, and property values to delay evictions?

3. HIDDEN AGENDA.

Dear Bankers, the money we give you doesn't solve your problem, because you

keep asking for more. What is the true problem? The

problems you claim to be solving (economic recovery) are not what you

spend the money on. What's the true problem? The talk is

the economy, but the money -- trillions -- goes to banks. I understand

economics; you tell me what the issue is with banks.

The

answer lies inside a pyramid of financial products, in which all the

layers are interlocked, the upper layers are worth the most money,

but the foundation, the Mom and Dad mortgages on the bottom, sets

the worth of everything. In a nutshell, homeowners are just an

inconvenience that must be recycled in order to preserve great wealth

and privilege at the top. We will have to review that

pyramid.

MORTGAGE MERRY-GO-ROUND. I first thought

the upper layers of the pyramid affected the foundation in only

one important way: recycling the money. If mortgage originators

can sell their mortgages to people who know how to form them into new

products (e.g., a bond or REIT, real estate investment "trust"),

then those products can be sold to a different class of

investor (wealthy buyers who are not interested in buying another

house) and -- ready? -- all the money comes back to the mortgage

originators, who can look for another set of customers, a new

neighborhood. After I understood how the mortgage merry-go-round kept recycling trillions in cash ($5.5 trillion regenerated by Fannie and Freddie MAC alone), how the industry was structured to keep demanding

more mortgages, then the industry drive to ever-more marginal deals

("sub-prime" mortgages), fraud and criminality became obvious. Without

market regulation, the children were doomed to fights and crying.

THE EVICTION PROCESS DOES NOT RESET THE MORTGAGE

When

my house sells, the new owner pays me (using his own down payment money

and mortgage arrangements) and I pay off my mortgage and move on to my

new house. But, alas, as long as my mortgage is written for more

than my house is worth, no one will buy my house, and I can neither

sell it nor pay the mortgage each month without shelling out "money for

nothing". My bank can't sell it either. The local

bank publishes a newspaper notice, someone stands on the grounds of the

county courthouse building and shouts into empty space at no one in

particular (he gets paid for this), and another "public auction" with

no attendees passes. (The bank's price might even be higher than the original mortgage, due to penalties and administrative fees.)

It

makes no sense financially, it makes no sense for the bank that

nominally holds the mortgage, not to do a mortgage "cram down",

resetting the loan to something more realistic that people will pay,

whether it's the owner in the house or anyone else. Yet this is

not happening in America. The banking industry lobbied Congress to avoid granting any judge

in a court of law the discretion to save any family brought before him.

This weakens the country's courts, as well as the country's

families.

AT

THE BOTTOM OF THE PYRAMID, NO ONE CAN HELP YOU. Here is

part of the answer. The "banks" going through

foreclosure-and-auction moves doomed to fail are not banks. These

are the mortgage originators (salesmen) or mortgage administrators

(billing agencies) at the bottom of the financial pyramid. They

do not own the mortgage, so they are not hurt if it does not sell.

Because they do not own the mortgage, their authority depends

on power-of-attorney-like paperwork to give them authority to evict,

hold the sham auction, etc. At the present time (October 2010)

this paperwork has been missing in so many foreclosures that the

foreclosures were illegal and were halted.

"Illegal" means "broke the law," but there has been no prosecution -- no

arrest, arraignment, trial, sentencing, jail. There has been

nothing, but something else is more important: the entire

foreclosure procedure has been hijacked by higher-ups in the financial

industry. None of the players here -- the mortgage originators,

the mortgage administrators, the paper-pushers working for a fee --

none of them have any authority to fix a mortgage that no one

will pay. It is a red herring, it is a diversion of our attention

as citizens to worry about "sloppiness" and "doing the paperwork

right."

The issue is getting stiffed when the sheriff

comes to throw you out. You have no push-back, no power to protect your own freedom. The

laws to protect homeowners are rendered irrelevant by the recent (last

10 years) transformation of the financial industry from a local bank

run by one of the "good" families in town that cares about other

families and the properties they live in. Instead, we all

face to a vast pyramid of players built on mortgages.

However good the paperwork gets, no one you deal with will give a

damn for saving you or your mortgage, or be in any position to do

anything about it if they do.

The

eviction process does not publicly reset the mortgage, it only flips

the occupant. Mortgages are re-written behind closed doors, as we

will see below.

Forget the paperwork and

fix a broken process with no protections -- you and the mortgage are

trash, and the industry will steadily recycle all the owners --

9 million homes will get rotated owners, according to current

foreclosure projections.

INVESTMENT BANKING'S PYRAMID OF FINANCIAL PRODUCTS

The industry's new pyramid of financial products changes the lending industry in two ways:

1. Recycling.

The money is recycled back to the loan originators so that mortgage sales can be driven down-market forever.

2. The money isn't in the mortgages, it just depends upon them.

Because

recycling is accomplished by turning each train load of mortgages (level

1) into a new product appealing to a new class of investors

(level 2; bonds, REITs), and those

products are bundled into a yet another, more derived financial

instrument (other collateralized debt obligations and derivative

contracts, level 3) and insurance is created based on the behavior of

all previous products (swaps, level 4) and offered to anyone already

in the pyramid, the value of the financial products based (ultimately) on mortgages is far greater than the mortgages themselves.

For example, the value of all mortgages in the USA today is, in

round numbers, 11 trillion dollars. But the value of outstanding

credit default swaps is 32 trillion dollars. That makes the

point, since these swaps were driven by the real estate boom. For

the record, all outstanding derivatives (many having nothing to do with

real estate) represent $614 trillion in obligations (Bank for International Settlement, June 2010 quarterly report

giving Dec 2009 data). What is the "load" on your mutual funds?

Have you got it down to 0.2 or 0.3%? Does your broker give

you any free stock trades? A commission of 0.1% on $614 trillion

in derivatives already sold and out there brought 614 billion dollars

in profit to this industry. Not revenues, profit.

COMMERCIAL & INVESTMENT BANKING DIFFERENCES. Commercial banking

gives real people real money to make investments in wealth-creating

businesses. Go here for commercial building mortgages or

industrial plant construction. Investment banking

is the gambling casino. Yes, it can perform useful functions when

everything goes right, just like capital punishment can never kill the

wrong person. For example, the funds multinational corporations

have to commit to spend -- or plan to win -- in big projects

overseas can be hurt by currency swings between the countries they work

in. It is not their fault. A "forward contract" derivative

guarantees their ability to buy the foreign money they will need later

at the exchange rate assumed when this year's budget was drawn up.

"Options" and "swaps" permit other protections.

Investment

banking is always the creatively wayward child. The constant

stream of newly-invented financial instruments evade tax laws and

financial regulation of any kind. The politician who says that

legislation has been passed so that XYZ will never happen again is a

fool. And people will

gamble with these toys. You and I may differ about the value to

society of gambling, but we should both be clear that lack of

transparency always sets the stage for manipulation and fraud.

Open markets (remember Republicans and Libertarians and the "free

market"?) open markets maximize social benefits and suppress

evil. For newly-invented financial instruments, there is not

yet a market, and sometimes that's the whole point -- to work behind

"closed doors". After the turmoil of market crashes and bank

runs (1929-1933), a separation of insurance, commercial banking, and

investment banking was imposed by the Glass-Steagall Act of 1933,

and repealed in 1999 by the Gramm-Leach-Bliley Act. The doc.com

crash was in early 2000, the telecom crash was early that Fall, and the

banking crash was in September 2008.

In our current

real estate bubble and crash, an investment banking pyramid was

created because of a familiar, powerful motivating force: each

new layer generates a new round of

commissions and other fees for the wizards who invent them. A

look at how the

pyramid was built shows that it is a house of cards, in that the higher

products are based on the lower ones whose value was willfully

falsified.

BUILDING THE PYRAMID OF MORTGAGES, BONDS, SWAPS. In the most important,

first step of pyramid building, mortgages were sold to "securitizing operations"

famously run by Fannie Mae and Freddie Mac (the Federal National

Mortgage Association, itself trading under the ticker FNMA, then FNA;

and The Federal Home Loan Mortgage Corporation, ticker FMCC, then

FRE, both finally delisted from the New York Stock Exchange last June,

2010). There, the individual mortgages were securitized into

bonds and other financial instruments. The bonds went to new

investors, some of them overseas. Packages of bonds were reborn

as other CDO's, "Collateralized Debt Obligations" and those went to a

third layer of even larger investors, many of them now significant

institutions with significant political access. At the fourth layer, insurance

policies were sold to some of these buyers against the possibility that

the revenue streams everyone expected to get (bond "interest rate" or

stock "dividend" to them; monthly payment to you) might dry up due

to a bankruptcy here or there in the financial pyramid. Simply to

avoid regulations still in effect for the insurance industry, the

insurance policies were called "credit default swaps". (See? No

word "insurance" in the name -- makes you wish you were a lawyer too, doesn't it?)

Credit

default swaps went to many municipalities and

pension funds around the world. They underwrote the policy and

expected to pocket a

steady stream of modest premium payments, but were liable for huge

underlying obligations if bankruptcies occurred. I recall a

"council shire" (county government) in rural Australia that had the

misfortune to meet a big city financial adviser. The shire

was ruined when a modest income stream turned into a crushing

debt. These "credit default swap"

insurance policies are the complex derivatives that brought down

AIG. By October 2009, it had taken $183B to buy back AIG's worthless

policies from irate

groups around the globe. As we saw with the UBS, the Union Bank

of Switzerland, most of the American tax payer dollars that went to AIG

were promptly shipped overseas. At least the shire in Australia

deserved it.

Laying all this out when it happened in 2008

showed me that the pyramid was big, big enough to persuade me that TARP

was needed. In those days, the problem looked billions big.

FAMOUS BANKRUPTCIES. Fannie Mae and Freddie Mac, two of the many large institutions that received

and securitized mortgages from loan originators (feet on the street)

and local banks, required $100 billion in rescue money, authorized

by the end of 2009, and another $100 billion in 2010. Today (21

October 2010), while I'm trying to get this out to you, the news

interrupts with assurance from the Federal Housing Finance Agency

(Fannie and Freddie's supervisory agency) that the total bill won't

reach $400 billion, even though last December President Obama lifted a

cap on taxpayer funding previously set at $400 billion, and even

though Fannie and Freddie hold about $1.6 trillion in mortgages.

Moving up the pyramid to the largest seller of credit default swaps, which earned palatial homes and private jets for so many at

American International Group's Financial Products Unit, we see AIG

getting an $85 billion bailout on 16 September 2008.

All by itself, this first

"tranche" was the largest government bailout of a private company in

history. $38 billion more followed on 9 October 2008, and $20B

on 30 November 2008, bringing AIG's total to $143 billion. By

October the next year, the AIG total had risen to $183 billion.

Knowing how much money was needed ahead of time was impossible

for them then, as it is for us and remaining banks now, because there

is no open market in many financial instruments listed on their

books from which to "get a quote" and assign a value, and because many

book values are fraudulent.

FAMOUS FRAUDS. Here,

high on the pyramid, products based on millions of home mortgages and

worth billions of dollars have been bought and sold between major

players. As fast as tax payer money went into AIG, AIG sent our money out to other banks, many overseas, many ($4 billion worth) not publicly accounted for. Quickly, a word on my favorite AIG beneficiary, the Union Bank of Switzerland,

UBS. UBS salesmen fanned out across the best country clubs

and highest dollar-a-plate charities in the US, offering anonymous,

numbered accounts to over 52,000 wealthy Americans for tax evasion.

How to get the money out of the country? No problem.

Buy diamonds, I'll take them back in my toothpaste tube. The

wealthy American tax evaders were never named, the IRS granted

them immunity from punishment for their Federal crimes if they paid the

IRS enough money, and the whistle blower who exposed UBS was the only one jailed

(maybe you need to read that again?). Wait, there's more.

One hand of the United States government succeeded in extracting

a $780 million fine from the bank for not paying taxes; the other hand

gave AIG billions of taxpayer bailouts from which AIG sent $5

billion to UBS. UBS defrauded our government -- hey, no big

deal -- but, with a whistle blower inside the bank, we can't cover this

up. Not to worry. Pay the bank enough to cover its fine,

maybe a few billion more, and, by the way, would you jail that

whistle blower?

Institutions

committed to fraud promote employees who get with the program, and fire

those who paint true pictures of perceived reality. Matthew Lee

never blew a whistle outside Lehman Brothers to get fired. His mistake

was to cite the company's code of ethics requiring accounting to comply

with "Generally Accepted Accounting Principles" and then deliver a

letter stating that "The Firm has tens of billions of dollar of

inventory that it probably cannot buy or sell in any recognized market,

at the currently recorded current market value [i.e.,at the value

recorded on the books today] . . .I do not believe the manner which the

Firm values that inventory is fully realistic or reasonable, and

ignores the concentration in these assets and their volume size given

the current state of the market's overall liquidity." PERSONAL AND CONFIDENTIAL: Lehman Brothers VP Matthew Lee's letter of 16 May 2008.

Not retired and still going to work? Maybe read Lee's oral testimony to Congress on the collapse of Lehman Brothers:

MATTHEW LEE:

I hand-delivered my letter to the four addressees and I'll give a quick

timeline of what happened, May 16th was a Friday, on the Monday I sat

down with the chief risk officer and discussed the letter, on the

Wednesday I sat down with the general counsel and the head of internal

audit, discussed the letter. On the Thursday I was on a conference call

to Brazil. Somebody came into my office, pulled me out, and fired me on

the spot with out any notification (voice falters, drinks water).

A bubble based on fraud is unstoppable from the inside.

The tremendous amount of money involved in

a pyramid with trillions at stake at the top

explains why any individual homeowner and his mortgage are trash. This pyramidal structure is why

trillions not billions are needed when recovery stalls and bets go

sour, why this money must go to the financial industry, not for

recovery of the country, and why many of those financial industry

recipients are overseas.

Let's look at the amounts.

Just like the oil that has disappeared from the Gulf,

so the bailouts have all been paid back to TARP (they say).

It is hard to know. The handing out of funds (e.g., $85B to AIG on

16 September 2008) preceded any legislative authorization (the

Troubled Asset Relief Program wasn't authorized legislatively

until President Bush signed the Emergency Economic Stabilization Act of

2008, hours after its passage on 3 October by the House, which had

previously rejected it). The government has worked hard not

to tally funds made available by the Executive Branch. We can

expect visibility of funds released by the semi-autonomous Federal

Reserve to be even more lacking.

HOW MUCH MONEY IS INVOLVED?

How

much money? So much that we have to print it at the Fed. No

budget is big enough to support such subsidies.

It

is striking how little talk there is about these Fed moves. The

total was at least 1.45 trillion dollars

before last Saturday's talk of more. This is not the $700B

in TARP funds (the Troubled Asset Relief Program. This is

another pile, already twice as high. There were an additional 1.2

trillion dollars worth of loans to foreign banks and governments in

2009 that we know about -- under questioning by Alan Grayson (D, FL),

Bernanke has refused to inform Congress of

the details. I thought I'd better get the numbers and let you

know as soon as I heard Fed Chairman Bernanke talking about a

third trillion-ish pile of money

last Saturday.

REAL ESTATE RELATED ASSETS PURCHASED BY THE FEDERAL RESERVE

$750B new purchases from banks in 2009

$500B previously purchased

$100B new purchases from Fannie Mae & Mac in 2009

$100B previously purchased

----------------

$1.45 trillion in purchased assets, not loans; twice the size of TARP

$1.2T known loans to overseas banks,

including the foreign central banks of 14 different foreign countries

http://www.federalreserve.gov/monetarypolicy/liquidity_swaps200906.htm

search "liquidity swap lines" for more info

$1 trillion more proposed by Bernanke, Saturday, 16 Oct 2010.

These only-approximate figures come largely from this article:

Fed to Pump $1.2 Trillion Into Markets

Greatly Expanded Purchases Are Designed to Lower Interest Rates, Stimulate Borrowing

By Neil Irwin Washington Post Staff Writer

Thursday, March 19, 2009

http://www.washingtonpost.com/wp-dyn/content/article/2009/03/18/AR2009031802283.html

The

$1.2 trillion to overseas banks started out as swaps of our currency

for theirs to stabilize the dollar. Then it got nastier.

The

foreign banks had worthless American assets and bank failures were

already starting to happen overseas. The U.S. Federal

Reserve had to step in and cover for us as a country. Most other

countries made it. Some were not so lucky (Iceland).

Our

country was turned into a fool on the global stage by private

players.

Some

of this partly hidden Federal Reserve money went out locally to save Goldman

Sachs but not Lehman Brothers. Some of the Goldman Sachs people

are in the government, but Lehman Brothers executives are not.

They say the $1.2 trillion was a loan and came back. Maybe it did. Except

for our reputation as a nation of free-market idiots, maybe it does not

matter.

THE

FEDERAL RESERVE DOES INTEREST RATE CONTROL WELL. Let me

defend

the Federal Reserve's independence for what the FOMC (Federal Open

Market Committee) does best. The FOMC sets interest rates to

stabilize the business cycle. The Fed should retain this power

and this independence. It's the corporate welfare for banks that

I do not like.

Congress

is mad and wants to take away some of the autonomy of the Federal

Reserve, which Congress sees as aloof and arrogant. Without

autonomy, the

Federal Reserve would do a more political job, and a less-good economic

job, of trying to even out our already boomy and busty economic

cycles. It is a depressing stand-off. One institution, now

dysfunctional and corrupted by money, is trying to make another

institution more

corrupt and dysfunctional. That institution

handed out perhaps a trillion dollars to foreign national banks

because our financial industry "masters of the universe" sold

so much of our real estate bubble junk overseas. It is the

FOMC, the Federal Open Market Committee, that traditionally decides

rates and recently has been printing trillions of dollars and either

loaning them (and claiming they came back) or spending them (and saying

next to nothing about getting them back). We need to keep one

function and curtail the other. In ever-mounting anger and

frustration, we'll probably damage the institution without making it

any better.

THE BANK'S GAME PLAN FANTASIES

The original plan:

Send money. Recapitalize the bankrupt banks until the toxic

assets recover.

Give banks billions from the Federal budget, get a fig leaf of

Congressional approval for some of it, feed the public a story about

"stress tests" on the banks to disguise their bankruptcy.

It will pass. It's just another economic cycle. The

attention span of the public is short. When recovery comes, the

banks can clean up their balance sheets by selling assets that have

recovered. The main thing is, save the banks, save the world.

The revised plan:

The recovery is slower than we thought. Congress is out of money,

ask the Federal Reserve to print some. Our own creditors are losing

confidence, so make it trillions not billions. I don't know

why mailing out over a hundred thousand foreclosure-related

documents each month, year after year, is so upsetting to consumers.

If we can steadily flip just 9 million families out of their

homes, everything -- swaps, CDOs, REITs, bonds, even the mortgages --

can be readjusted and our books won't be fraudulent anymore. The

main thing is, save the banks, save our world. Keep a steady

foreclosure pace. The

stress of a foreclosure moratorium is starting to drive one CEO I know out of his mind.

(JIN: If your Internet connection is good, try the full screen version.

This parody takes off on House Resolution HR3808 which would have

legalized document robo-signing and bestowed immunity on illegal

foreclosures. Our Congress passed the bill -- is anyone

surprised? -- but President Obama in turn surprised the financial

industry by refusing to sign it into law.)

The actual situation:

Money given to banks will bring anger, not economic recovery, to

our nation. This anger makes people more ungovernable (e.g., Tea

Party) at the same time that economic failure and criminal injustice

makes the government less legitimate. Toxic assets taken off the banks'

books and hidden in the Federal Reserve were purchased for real cash.

When this printed money cannot be withdrawn from circulation (the

Fed can't trade the toxic "assets" back again), inflation will wipe out

the value of many people's savings and pensions, and impede private

sector investment needed for actual wealth production.

HOLDING ON UNTIL RECOVERY -- THEIR RECOVERY. The

banks must hold on until millions of homes can be re-filled with people

who have jobs and will pay the mortgages. During this time, the

mortgages must not change face value publicly. Any move toward a

mortgage's true value reveals the true value of the banks assets.

The public would be tipped off to the

banking crisis's true severity. So how do mortgages get reset to reality?

Once

the foreclosure is over and the charade of a bank auction has passed,

the house becomes "REO" (real estate, owned) and passes up the pyramid

to levels where mortgages are securitized. Mortgages in the

securitized bundle are changed out of public view, and the homes are

filled with new people that have jobs and will pay them.

The foreclosure pace is timed to keep the real estate market from becoming too depressed.

Meanwhile, no

leader in politics, the media, or Wall Street is saying that failed banks

should close and the bonuses for those who ran them should end

forever. Without accountability, we teach our ruling elites to

abuse the law, our society, and us. It is a price not measured in dollars.

MULTIPLE LAYERS OF FRAUD

Willful

betrayal of trust to obtain something of value is fraud. The idea

that fraud was willfully committed by privileged financial industry

leaders is the theme of a new Sony Classics Film, "Inside Job." Here's the story without pictures.

1. Liar loans, the first layer of fraud.

The

endless supply of recycled money for more loans pushed mortgage

originators into circumstances they should never have entered.

People applied

for a mortgage without establishing their assets or income. If

the applicant did not lie, the agent trying to sell the mortgage lied

for them ("Here, I can help you with the paper work.") The payoff

(the fees and commissions) was for completing the deal, not for getting

a good deal.

Insiders

called these "liar loans" or "Ninja loans": no income

verification, no job verification, no verification of assets. The

documentation of many "liar loans" is fraudulent, so the data in the

server farms of Fannie Mae and Freddie Mac was false, so the credit

rating agency ratings of the securitized mortgages, bonds, and REITs

were fraudulent, so the trust of investors was knowingly violated, so

the industry as a whole defrauded investors world-wide.

If

you prefer to say, "It was John Doe's fault for signing up for a

mortgage John knew he couldn't afford," then go ahead and say it.

But if John tells the agent, "I don't think I can afford this," then

the agent will say, "Don't worry, go ahead, in 1 year you can sell it

for more than you paid, so you'll be able to put more money into your

next house. It is a good investment." If you still

prefer to say, "It was John's fault for not taking personal

responsibility for his own actions" then it is time to ask where you

got that line from, and what their interest might be in getting you to

repeat it for them, other than merely to distract you from seeking a better understanding than such a stupidly narrow one.

Paying

off participants (the mortgage brokers) to falsify documentation

-- structuring the payoffs to get the inevitable result -- soon opened

new markets for the mortgage-lending industry. Leading the race

to the bottom was the Independent National Mortgage Corporation, which

destroyed $32B of its own listed assets by declaring bankruptcy

31Jul 2008 (two months before TARP). Worse than the demise of "IndyMac" itself was the $80B pulled in from other financial institutions when it sold

them assets based on the Indy Mac mortgage business. Assets

derived from mortgages of little value covered by fraudulent paper

work are "toxic assets." The biggest seller of "liars loans" was Lehman Brothers, now also bankrupt.

Within

the industry, it is assumed that liar loans will blow up, and

derivatives are created to make money on their fall, most famously by John Paulson and Goldman-Sachs.

2. Credit rating agency fraud.

Credit rating agencies (Fitch, Moody's, Standard &

Poor) gave the mortgage-secured assets AAA ratings, making themselves

accomplices to a fraud that makes Bernard Madoff insignificant.

(Madoff made off with about $18 billion; the

Federal Reserve and Congress have put $2,000 billion in play so

far.) You can say that these agencies were victims, like others,

of the fraudulent paperwork of ninja mortgages and liar loans.

However, when Fitch checked paperwork post hoc (after the crash), it

immediately found " there was the appearance of fraud in nearly every

file we examined." Later work reported by William K. Black shows

fraud in 90% of liar loans (loans made under the provisions Alt-A,

"alternative documentation".

Spot

checks were their job. By not performing their job, the credit

rating agencies aided and abetted industry-wide fraud.

Bottom-fishers in the industry could then drive better firms into

markets (neighborhoods; personal income brackets) they would not have

entered. The credit rating agencies helped soon-to-be-bankrupt mortgage

originators like IndyMac spread toxic derivatives of those mortgages around the globe.

Overseas, big foreign banks and small rural counties ("shire

councils") in Australia, looking for places to park funds, purchased

toxic assets based on fraud, produced in America because she would not

regulate -- bring transparency to -- her markets.

3. Database fraud.

Databases

are kept for every individual mortgage in a securitized mortgage

instrument, many at the huge McLean,VA server farms of Freddie

MAC (yellow dots, photo). These databases give the illusion of transparency (right

down to an image of original pages of paperwork) and give the illusion of

a "quantitative" means to calculate the face value of a

securitized mortgage. They provide the lookups needed by the

mortgage administrator to run his billing operations. The fraud

of the falsified application is enshrined in these databases. The

databases undermine all attempts to assign "true value" to all layers

of derivative financial instruments built upon them. We cannot

know the true value of the $32 trillion in credit default swaps still

on the books of the world 's banks as of 12/09. Securitized

mortgage bundles, collateralized debt obligations and credit default swaps on banks' books

may not be the "assets" they seem.

Databases

are kept for every individual mortgage in a securitized mortgage

instrument, many at the huge McLean,VA server farms of Freddie

MAC (yellow dots, photo). These databases give the illusion of transparency (right

down to an image of original pages of paperwork) and give the illusion of

a "quantitative" means to calculate the face value of a

securitized mortgage. They provide the lookups needed by the

mortgage administrator to run his billing operations. The fraud

of the falsified application is enshrined in these databases. The

databases undermine all attempts to assign "true value" to all layers

of derivative financial instruments built upon them. We cannot

know the true value of the $32 trillion in credit default swaps still

on the books of the world 's banks as of 12/09. Securitized

mortgage bundles, collateralized debt obligations and credit default swaps on banks' books

may not be the "assets" they seem.

An

alternative way to determine value is "the voice of the market."

If there were an open market in these financial instruments, one could

"mark to market." However, many banks would fail, and the crisis

in confidence which that would produce would take down

others. If we preserve the corrupt and bankrupt

institutions, then no structural change can occur in financial markets

until all fraud is flushed out of the system (until every

delinquent mortgage is foreclosed). Until then, the Federal

Reserve will print as much money as the fig leaf fiction takes.

Until then, homeowner foreclosures are desirable, and mortgage

renegotiations that make true value transparent are to be avoided.

Without

regulation, bottom feeders take an entire industry to the gutter, and

reputable firms are pressured to either join or lose out. The

purpose of regulation is to make business sustainable, and to make

competition occur on the basis of quality of product, not

audacity in the willful betrayal of trust.

Business leaders cannot favor business-sustaining regulations because they cannot admit that they act like children.

MARKETS CRASH BUT AIRPLANES FLY -- DO YOU EVER WONDER WHY?

An

interview of William Black by Bill Moyers on National Public Radio in

early 2009 crystallizes the element of fraud.

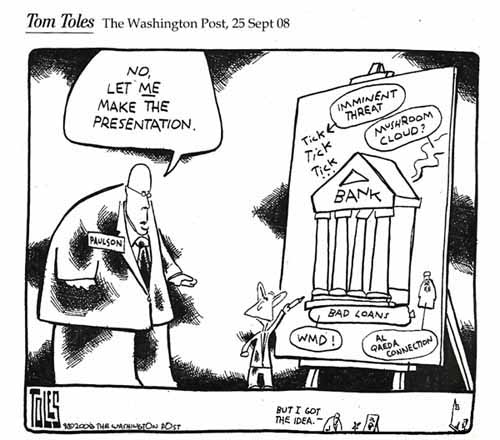

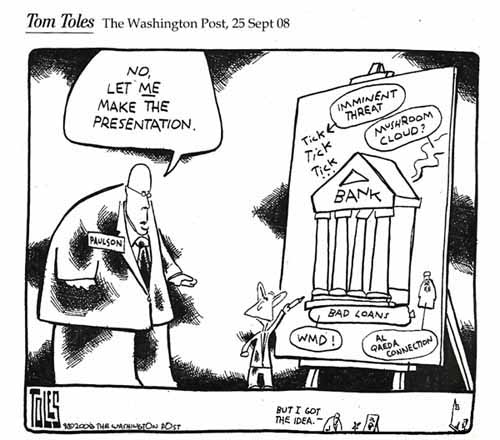

WILLIAM K. BLACK:

Geithner is publicly saying that it's going to take $2 trillion — a

trillion is a thousand billion — $2 trillion taxpayer dollars to deal

with this problem. But they're allowing all the banks to report that

they're not only solvent, but fully capitalized. Both statements can't

be true. It can't be that they need $2 trillion, because they have

masses losses, and that they're fine.

These

are all people who have failed. Paulson failed, Geithner failed.

Geithner is ... covering up. Just like Paulson did before him.

WILLIAM K. BLACK:

This is being done just like Secretary Paulson did it. In violation of

the law. We adopted a law after the Savings and Loan crisis, called The

Prompt Corrective Action Law. And it requires them to close these

institutions. And they're refusing to obey the law.

BILL MOYERS: What the reason they give for not doing it?

WILLIAM K. BLACK: They ignore it. And nobody calls them on it.

BILL MOYERS: Well, where's Congress? Where's the press? Where--

WILLIAM K. BLACK: Well, where's the Pecora investigation?

[JIN: The banking industry malfeasance and conflicts of interest uncovered

by the Pecora Commission led to the Glass-Steagall Banking Act of

1933. The 1999 repeal of Glass-Steagall is widely cited as the

foundation of the present banking crisis.]

BILL MOYERS: The what?

WILLIAM K. BLACK:

The Pecora investigation. The Great Depression, we said, "Hey, we have

to learn the facts. What caused this disaster, so that we can take

steps, like pass the Glass-Steagall law, that will prevent future

disasters?" Where's our investigation?

What

would happen if after a plane crashes, we said, "Oh, we don't want to

look in the past. We want to be forward looking. Many people might have

been, you know, we don't want to pass blame. No. We have a nonpartisan,

skilled inquiry. We spend lots of money on, get really bright people.

And we find out, to the best of our ability, what caused every single

major plane crash in America. And because of that, aviation has an

extraordinarily good safety record. We ought to follow the same

policies in the financial sphere.

--end extract from April 2009 interview ( full transcript; video ).

============================

William Kurt Black

(b. 1951) is an American lawyer, academic, author, and a former bank

regulator at the national level with expertise in white-collar

crime. His concept of "control fraud" summarizes how

a business or national executive uses whatever institution they

control as a "weapon" to commit fraud. Black

served as Deputy Directory of the Federal Savings and Loan Insurance

Corporation (FSLIC) and as litigation director for the Federal

Home Loan Bank Board, later called the Office of Thrift

Supervision. Black is currently an Associate Professor of

Economics and Law at the University of Missouri-Kansas City School of

Law.

Black's

book, "The Best Way to Rob a Bank Is to Own One: How Corporate

Executives and Politicians Looted the S&L Industry" (2005, 351 pp) drew this praise from a former Chairman of the Federal Reserve:

"Bill

Black has detailed an alarming story about financial and political

corruption….the lessons are as fresh as the morning newspaper. One of

those lessons really sticks out: one brave man with a conscience could

stand up for us all."

--Paul Volcker

Black's book drew this comment from someone on amazon.com:

"One

of the lessons Mr. Black would like to get across is that FRAUD

HAPPENS. ... Fraud is not accidental. It will arise when conditions

make for opportunities. ... I

can't avoid the conclusion that the environment that resulted in

corruption 20 years ago is still with us. And I begin to think that

Obama's economic advisors will not change things." --Rita Sydney,

Walnut Creek, CA

Bill Moyers (b.

1934) is an American journalist who served as White House Press

Secretary for President Lyndon B. Johnson (1965-1967). He

production of radio and TV series and documentary films has brought him

numerous awards and honorary degrees.

---o=o---

THE VAST WEALTH of the DERIVATIVE WORLD

Creativity

produces new, more "derived" financial instruments. Offering them

for sale produces cash for their creators.

The

total face value of derivatives of all kinds on the books as of 12/09

is $600 trillion (Bank for International Settlements (BIS) Quarterly

Review, June 2010). A broker's commission of one-tenth of one

percent on the sale of these financial instruments would bring the

financial industry $600B in immediate, hard cash. This is without

the origination fee, the placement fee, trade clearance fees, custodial costs, etc.

This is how the financial industry is incentivized to -- this is how we

pay them to invent a financial instrument, sell it, package those

financial instruments into a new one and sell those too.

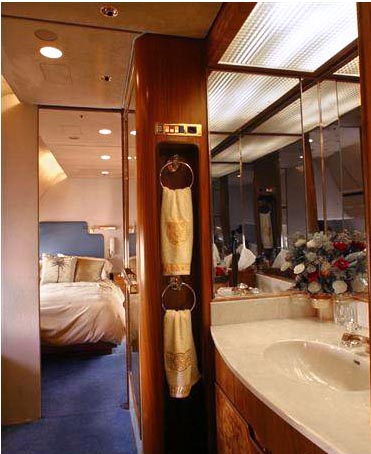

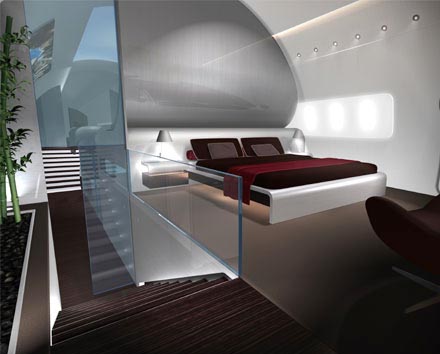

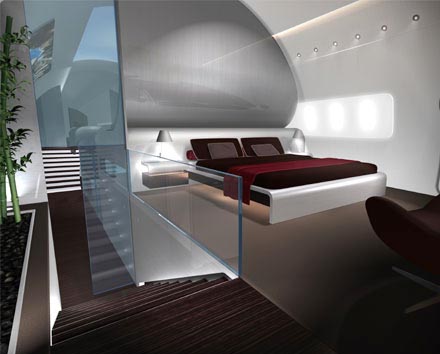

Pictures

of corporate and private jets brought home to me why we cannot expect these people

to think about the welfare of anyone but themselves.

Think of your last airplane flight. The captain turned off the seat belt sign.

You got up and went to the galley and bathrooms in the back of your plane.

(Private 707, galley area.)

Think of your last long flight. You hoped for a row of empty seats so you could stretch out.

This private jet has a double bed. Perhaps the design is too traditional, considering the money it costs.

Most corporate jet interior designs provide a lounge and bar area, dining area, and sleeping quarters.

Charles Ferguson's new (Oct 2010) movie "Inside Job" from Sony Classics emphasizes the palatial wealth that financial

industry executives made off the backs of ordinary home owners, and the

knowing fraud they committed on those who bought their securities.

CONCLUSION: A BLEAK FUTURE

1. No halt in foreclosures

There

will be no moratorium in foreclosures and no cram-down in

mortgage values. There will be no relief from home foreclosures

because bringing homes to their true value brings insolvent financial

institutions closer to their true value. A pyramid of

creative -- and lucrative -- financial instruments has been built on

these mortgages, and revealing that the mortgage values are

fraudulent will collapse the pyramid. Instead of changing the mortgages

in any publicly visible way, the owners must be flipped. Many

overseas government

and banks hold these investments, so fixing them will require shipping

money to foreign entities, not just American ones.

2. The government will print money and give it to the Executive Branch by buying U.S. Treasury bonds.

Once

occupants are evicted and the "bank auction" has predictably failed,

the house passes up the chain to financial institutions holding bundles

of securitized mortgages, where new owners are inserted and the

securitized mortgages (bonds or other instruments) are made viable

again.

To

insert new owners into the houses, cheap money must be available.

Buying Treasuries with printed money makes cheap money available

because it drives down interest rates of all loans, not just Treasury

bonds. If you can sell any kind of debt in a heartbeat

because the U.S. Federal Reserve acts like a private sector buyer, then

you don't need high interest rates to attract loan money. Home

loan rates will fall until the Fed comes to the end of its next

trillion (October 2010, proposed).

Seeing

the problem as "creating cheap money" in order to "insert a new owner"

into the home means the problem is seen as restarting a bubble, as

rebooting the system to where it stood when it crashed. Any grasp

of job creation is absent. Any grasp of the harm done to the

evicted

family, the education of their children, or the neighborhood is absent.

3. The government will print money (trillions) and give it to the banks

in exchange for "assets" of questionable value that cannot be sold

back to where they came from. The inability to later withdraw

this cash from the money supply will produce inflation severe enough to

destroy a stable climate for business investment.

4. No economic recovery will occur.

Transferring

wealth does not create it. Recovery does not come from

transferring wealth to the financial class, any more than prosperity

"trickles down" by exempting the wealthy from supporting the society in

which they live through paying taxes like the rest of us.

We

are protecting incompetent people who drove their own institutions

bankrupt. The fraud, the fiction that banks were OK, wore thin

when (surprise?) economic recovery didn't come fast enough.

The banks are still foreclosing, the mortgages are still not crammed

down, but it isn't working. With little value returning to the

houses, it is time to simply inject pure cash directly into the

banks. This has been done is three tranches: $700B in TARP

money to banks, over $1.45 trillion in printed money

through 2009, and new proposals coming at the end of 2010.

We have incurred a cost of 3 trillion dollars for wars of choice (book by Joseph E. Stiglitz;

today this Nobel Laureate in Economics puts the cost at 4

to 6 trillion dollars, in part because the care of vets coming home is

not fully unacknowledged and underfunded. I have said something

sad and disgraceful as correctly as I can.) These wars have

weakened our world standing and have made us irrelevant rather than

powerful. We are now incurring costs of 3 or more trillion

dollars

for our free market foolishness.

None

of this money for corrupt banks and poorly-chosen wars has been

invested to build

- a strong national infrastructure,

- a strong

rising generation, or

- a prosperous nation.

If

enough money is printed today and not withdrawn from the money supply

tomorrow, we will have inflation high enough to make business and

business investment more difficult. This country is headed in the

wrong direction. "Left" and "right" are not relevant if the

direction to change is "down."

5. Failures of leadership will get worse.

The credibility of US power is weakened when we drag others down with our mistakes, and then refuse to learn from them.

Institutions

committed to

fraud promote employees who get with the program, and fire those who

paint true pictures of perceived reality, even if there is no

whistle-blowing outside the firm. A bubble based on fraud is

unstoppable from the inside. Since President Obama populated his

administration with insiders -- up to Cabinet and Fed Reserve Board

Chairman levels -- there has been no criminalization of fraud from

the outside.

The

current generation of privileged, influential people who ran the

financial collapse today will do greater harm to the rest of us and to

our country tomorrow. New realms of dysfunctional government and

social injustice lie ahead. This has now become

inevitable, because we let people today, in our generation and in our

time, reward themselves for failure, and we have not jailed them

for fraud.

COMIC RELIEF

Good

grief, you read this? It's so outrageous, it's funny. Throw your

head back and laugh at it with Jon Stewart, host of Comedy Central's

"Today Show". One of these links should get you there:

--jerry

PREFACE I didn't get it. I blundered at first.

INTRO What is the Fed buying? Where does it get the money?

DEFLATION 101

INFLATION 101

WHAT's MISSING? WHY IS NOTHING GETTING FIXED?

THE EVICTION PROCESS DOES NOT RESET THE MORTGAGE

INVESTMENT BANK's PYRAMID of FINANCIAL PRODUCTS

How it drives the industry.

Commercial & investment banking differences.

Building the pyramid of mortgages, bonds, swaps.

Famous bankruptcies.

Famous frauds.

HOW MUCH MONEY WAS HANDED TO BANKS?

It used to be billions.

THE BANK'S GAME PLAN FANTASIES

Waiting for a recovery that won't come.

MULTIPLE LAYERS OF FRAUD

1. Liar loans. 2. Credit agencies. 3.

Data bases.

MARKETS CRASH, but AIRPLANES FLY

An interview of William K. Black by Bill Moyers.

THE VAST WEALTH of the DERIVATIVE WORLD

Palatial homes, corporate and private jets.

CONCLUSION - A BLEAK FUTURE

1. No foreclosure halt.

2. The government prints money.

3. No economic recovery

4. Continued failure of leadership.

COMIC RELIEF - Jon Stewart

top of this page companion article, what went wrong 2008? politics area home for the entire site

Easy links: HousingFraud.notlong.com (this one)

Bailout.notlong.com (2008)

Rev 22Oct2010

feeling. People are not

itchy to find some way to get "it" now, whether "it" is a

franchise on the corner, or brand recognition and market share

for a new product. People are not itching to get "it"

before someone else does ---not itching to do "it" even if they

have to borrow today to achieve their Great Tomorrow. Using force

to pull a house away from someone against their will is humiliating and helps people to feel this way.

feeling. People are not

itchy to find some way to get "it" now, whether "it" is a

franchise on the corner, or brand recognition and market share

for a new product. People are not itching to get "it"

before someone else does ---not itching to do "it" even if they

have to borrow today to achieve their Great Tomorrow. Using force

to pull a house away from someone against their will is humiliating and helps people to feel this way.

There

is also real value in all bubbles. Some of the dot-coms have

value (Yahoo, eBay, Amazon, Google). Some of the

telecommunications networks have value (Level Three). Some of the

real estate is desirable, currently occupied by prosperous owners, and

still carries an older, more reasonable price tag. But we can

create new ventures on paper faster than we can build them into

profitability (dot-coms). And too much of a good thing produces a

saturated, commoditized market in which prices shrink and profits

vanish (for telecom networks phone calls -- once a $100B business

for local calls and $80B for long distance ones -- are

suddenly free). Any value set chiefly by

psychology is free to attain irrational values (real

estate). Bubbles (dot com, telecom) produce a lot of trash

investments. We will see that in a really good bubble like

the American real estate bubble that burst in 2008, more than

psychological irrationality (in personal choice) and market frenzy (in

setting value) were at play. Bad investments were produced by

willful fraud. (The cartoon is by Barbara Smaller. Get it on a mugs or T-shirts at cartoonbank.com.)

There

is also real value in all bubbles. Some of the dot-coms have

value (Yahoo, eBay, Amazon, Google). Some of the

telecommunications networks have value (Level Three). Some of the

real estate is desirable, currently occupied by prosperous owners, and

still carries an older, more reasonable price tag. But we can

create new ventures on paper faster than we can build them into

profitability (dot-coms). And too much of a good thing produces a

saturated, commoditized market in which prices shrink and profits

vanish (for telecom networks phone calls -- once a $100B business

for local calls and $80B for long distance ones -- are

suddenly free). Any value set chiefly by

psychology is free to attain irrational values (real

estate). Bubbles (dot com, telecom) produce a lot of trash

investments. We will see that in a really good bubble like

the American real estate bubble that burst in 2008, more than

psychological irrationality (in personal choice) and market frenzy (in

setting value) were at play. Bad investments were produced by

willful fraud. (The cartoon is by Barbara Smaller. Get it on a mugs or T-shirts at cartoonbank.com.)

When

the psychology changes, the bubble bursts. The "bursting" is not

economic, it is psychological. People shove all companies towards

bankruptcy as indiscriminately as they shoved money towards any company

during the bubble. Inflation, booms and bubbles (followed by

busts, recessions and depressions) destroy wealth insofar as money that

could be doing good things is tied up in silly things instead during

the boom. When the bust comes, wealth is destroyed as

companies disassemble themselves, liquidate and sell off

what would otherwise have done good for the owners, done good for

their investors, and done good for the country. We never get to

enjoy the goods and services, the innovative methods they were

trying to create.

When

the psychology changes, the bubble bursts. The "bursting" is not

economic, it is psychological. People shove all companies towards

bankruptcy as indiscriminately as they shoved money towards any company

during the bubble. Inflation, booms and bubbles (followed by

busts, recessions and depressions) destroy wealth insofar as money that

could be doing good things is tied up in silly things instead during

the boom. When the bust comes, wealth is destroyed as

companies disassemble themselves, liquidate and sell off

what would otherwise have done good for the owners, done good for

their investors, and done good for the country. We never get to

enjoy the goods and services, the innovative methods they were

trying to create. Databases

are kept for every individual mortgage in a securitized mortgage

instrument, many at the huge McLean,VA server farms of Freddie

MAC (yellow dots, photo). These databases give the illusion of transparency (right

down to an image of original pages of paperwork) and give the illusion of

a "quantitative" means to calculate the face value of a

securitized mortgage. They provide the lookups needed by the

mortgage administrator to run his billing operations. The fraud

of the falsified application is enshrined in these databases. The

databases undermine all attempts to assign "true value" to all layers

of derivative financial instruments built upon them. We cannot

know the true value of the $32 trillion in credit default swaps still

on the books of the world 's banks as of 12/09. Securitized

mortgage bundles, collateralized debt obligations and credit default swaps on banks' books

may not be the "assets" they seem.

Databases

are kept for every individual mortgage in a securitized mortgage

instrument, many at the huge McLean,VA server farms of Freddie

MAC (yellow dots, photo). These databases give the illusion of transparency (right

down to an image of original pages of paperwork) and give the illusion of

a "quantitative" means to calculate the face value of a

securitized mortgage. They provide the lookups needed by the

mortgage administrator to run his billing operations. The fraud

of the falsified application is enshrined in these databases. The

databases undermine all attempts to assign "true value" to all layers

of derivative financial instruments built upon them. We cannot

know the true value of the $32 trillion in credit default swaps still

on the books of the world 's banks as of 12/09. Securitized

mortgage bundles, collateralized debt obligations and credit default swaps on banks' books

may not be the "assets" they seem.